In land, organizations can analyze properties by utilizing the proportion. Personal property, loan payments, and capital improvements, on the other hand, are not included in operational expenses. Property management fees, landscaping, attorney costs, landlord’s insurance, and basic property insurance are all additional operational expenses that investors should factor into the OER.

Since overseeing opportunities are remembered for effective property the board, remembering opening for an OER gives a more precise image of working costs and shows where upgrades might be made. Instead of utilizing potential rental income to account for vacancies, investors should use effective rental revenue, which is potential rental income minus vacancy and credit losses. The principal things remembered for the working cost incorporate property the board, local charges, utilities, compensation, protection, expenses, supplies, fixes and support, promoting, bookkeeping charges, lawyer charges, bother control, junk expulsion, and comparative more. Over the long run, changes in the OER demonstrate whether the organization can build deals without expanding working costs proportionately (i.e., if the business is adaptable).

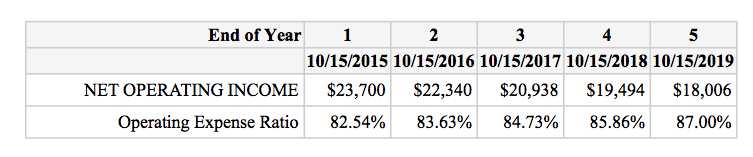

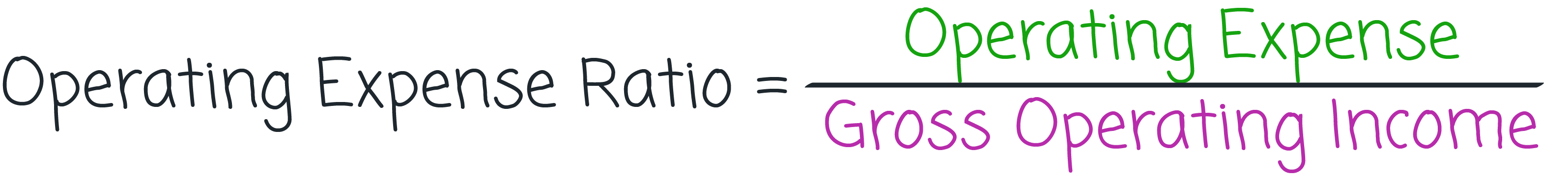

If the operating ratio is smaller, on the other hand, the corporation will view the property as a good investment.If the operating ratio is higher, the company would think twice about keeping the property.The corporation would look into OER to see how the property is doing. As a result, the longer the investor holds the property, the more money they risk losing.įor instance, a company may have purchased a property to rent out to other smaller businesses. If a property’s costs increase at a faster rate than its income, the OER grows as well. Calculating OERs over various years may help a financial backer notification a property’s patterns in working costs. The investors utilizing this proportion can additionally look to a detriment including protection, utilities, charges and support, to the gross pay, and the amount, all things considered, to the gross pay. The income earned by a certain property is referred to as revenues. Utilities, property management fees, upkeep, property taxes, insurance, and repairs are all examples of running expenses in the real estate market. The most crucial component is the first.This ratio is more beneficial in the real estate industry, so let’s look at OER from that lens. Investors prefer a lower operating expense ratio (OER) since it indicates that expenses are kept to a minimum in relation to revenue. Operating expense ratio (OER) = Operating Expenses / Revenues The operating expenses ratio formula is, simply, operating expenses divided by revenue: On the off chance that a specific property piece includes a high OER, a financial backer should accept it as a notice sign and investigate the matter for what reason is the OER high.

It is a useful tool for comparing the costs of comparable properties. The recommended OER percentage is between 60% and 80% (although the lower it is, the better). In land examination, the investigators judge the expense of working property with the pay created by the property.Īn investor should be on the lookout for red signs, such as greater maintenance costs, operating revenue, or utility costs, that could prevent him from buying a certain property. OER is mainstream in the land business, and it is a typical proportion that is utilized while doing the land investigations. It’s computed by dividing a property’s total operating income by its operating costs (minus depreciation). The operating expense ratio (OER) is a method of calculating the cost of operating a piece of property in relation to the income generated by that property.

0 kommentar(er)

0 kommentar(er)